Independent research supports the need for—and the benefits of—school choice. Read what the research says about school choice.

The case for school choice is overwhelming. The vast majority of credible evidence shows that school choice programs improve academic outcomes for not only the program participants but also the students in public schools; save taxpayers money; and reduce racial segregation. To download a summary of school choice research, click here.

A study from the Urban Institute released in February 2019 shows better outcomes for students in Florida who attend private K-12 schools thanks to the state’s school choice program. The Florida Tax Credit Scholarship program serves 100,000 students with an average family income of $24,000 per year, and 68 percent of the students are African American or Hispanic. Notably, according to the most recent comparison, the scholarship funding is only 55 percent of the dollar amount of per-pupil spending in the state of Florida.

The Urban Institute study shows that students attending private schools via the scholarships are up to 99 percent more likely to enroll in four-year colleges and are up to 56 percent more likely to earn bachelor’s degrees compared to their similarly matched public school peers.

Summary of findings (compared to public school peers)

GRADES 3-7:

– Students who began using the Florida Tax Credit Scholarship to attend private K-12 schools in grades 3-7 were 12% more likely to enroll in any college, and 16% more likely to enroll in a four-year college. These students were also 11% more likely to earn bachelor’s degrees.

– If these students used the scholarship to attend private schools for 7 years or more, they were 45% more likely to enroll in four-year colleges and 56% more likely to earn bachelor’s degrees.

GRADES 8-10:

– Students who began using the Florida Tax Credit Scholarship to attend private K-12 schools in grades 8-10 were 19% more likely to enroll in any college, and 43% more likely to enroll in a four-year college. These students were 20% more likely to earn bachelor’s degrees.

– If these students used the scholarship to attend private schools for four years or more, they were 99% more likely to enroll in four-year colleges and 45% more likely to earn bachelor’s degrees.

The new findings expand on the 2017 work by the Urban Institute on the Florida school choice program. The new study includes data from private colleges and from non-Florida colleges, whereas the previous study only included data from public colleges in Florida.

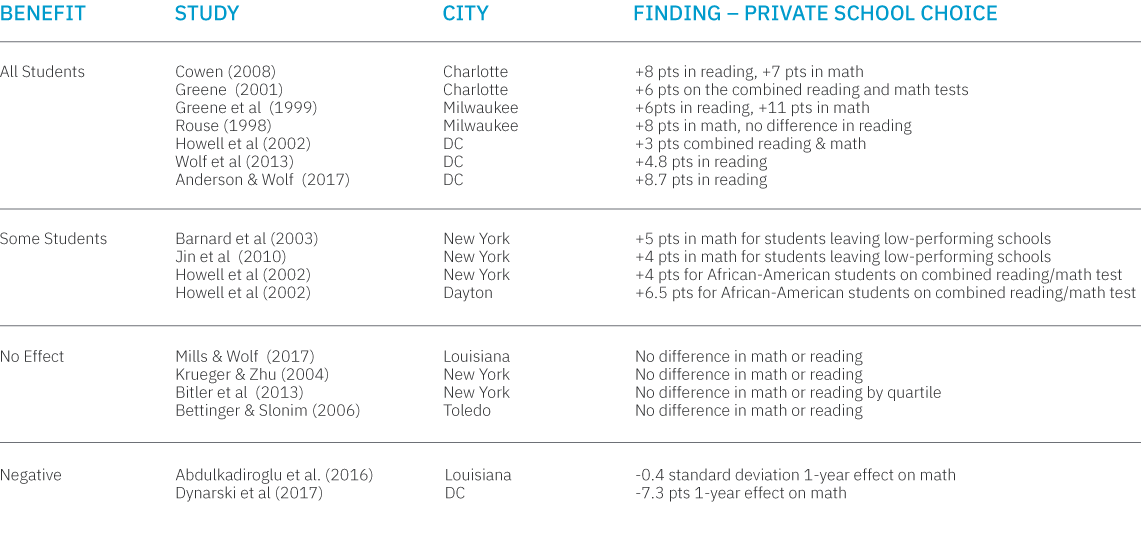

17 empirical studies examined academic outcomes for students participating in private school choice using random assignment, the “gold standard” of defensible social science:

• 11 found improved test scores for school choice participants

• 4 found no significant effect for school choice participants

• 2 found negative impact in the early years of study for school choice participants

17 empirical studies examined academic outcomes for students participating in private school choice using random assignment, the “gold standard” of defensible social science:

• 11 found improved test scores for school choice participants

• 4 found no significant effect for school choice participants

• 2 found negative impact in the early years of study for school choice participants

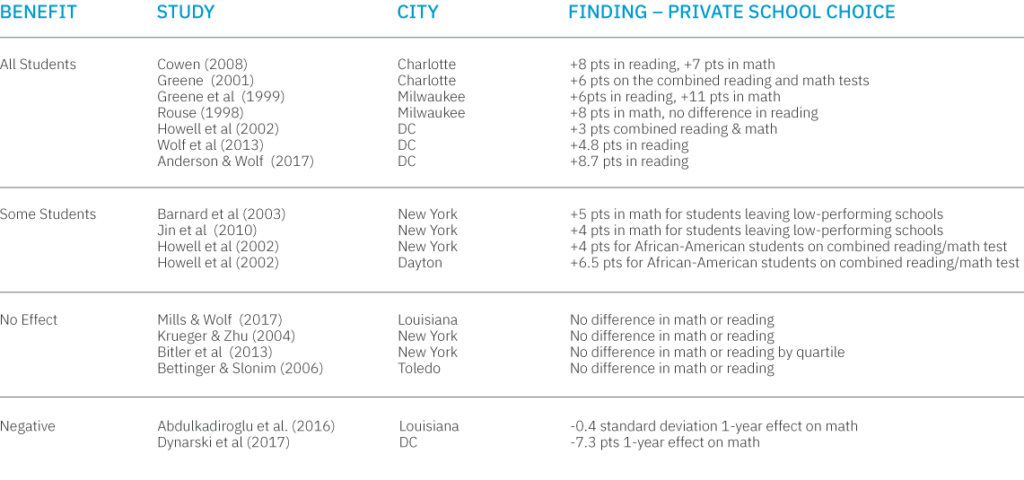

21 empirical studies examined school choice and how it impacts academic outcomes in public schools:

• 20 found that school choice improved public school academic outcomes

• 1 found no significant effect on academic outcomes from school choice

28 studies examined the financial impact for the taxpayers and public schools:

• 25 found that school choice programs save taxpayers money

• 3 found that school choice programs are revenue neutral

• None found that school choice programs have a negative fiscal impact

28 studies examined the financial impact for the taxpayers and public schools:

• 25 found that school choice programs save taxpayers money

• 3 found that school choice programs are revenue neutral

• None found that school choice programs have a negative fiscal impact

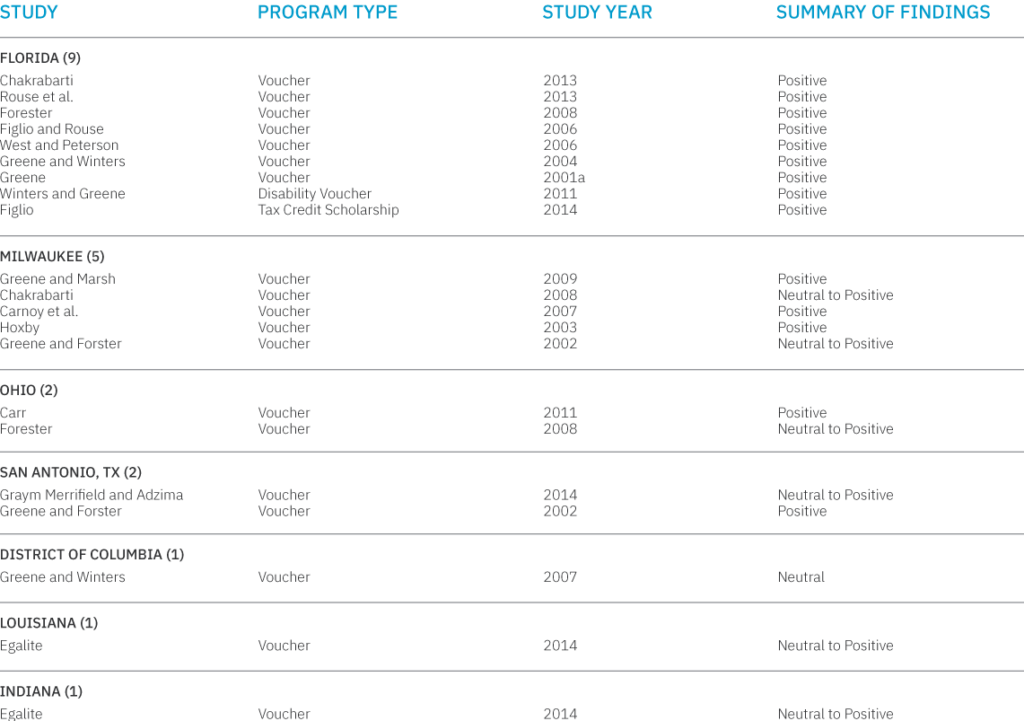

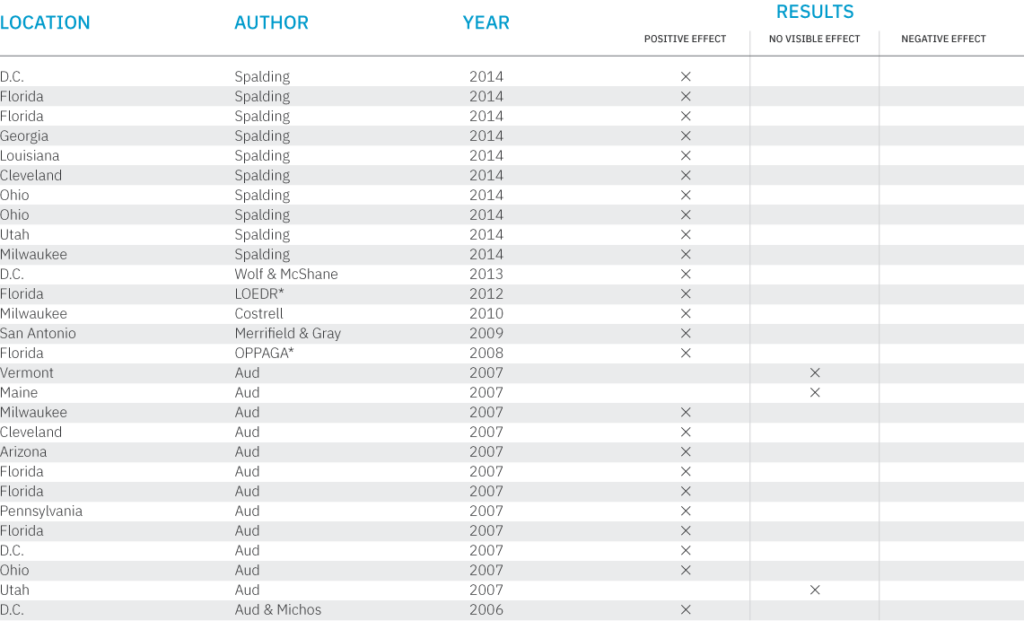

10 studies examined the impact of school choice on racial segregation:

• 9 found that school choice programs move students into less segregated schools

• 1 found that school choice programs have no net effect on racial segregation

• None found that school choice programs increase racial segregation

Note: This table shows all empirical studies using all methods the total effect on segregation in all schools is referenced.

FLORIDA – URBAN INSTITUTE STUDY ON COLLEGE ENROLLMENT

Urban Institute Study Facts:

This is the first study that has measured the long-term education outcomes for students in a private school choice program at the statewide level. The program that Dr. Chingos of the Urban Institute studied is the Florida Tax Credit Scholarship Program (FTC).

See the full study here: http://urbn.is/2k1pJvh.

The results are clear: The Florida school choice program significantly increases college matriculation, especially when students were enrolled in the Florida Tax Credit Scholarship Program for a longer period of time.

“Enrollment effects are concentrated at two-year colleges, but for students who entered FTC in elementary or middle school, there is a positive impact on four-year college enrollment of 0.9 percentage points (15 percent) after three years of participation and 1.5 percentage points (25 percent) after four or more years.” (p.20)

And this data only looked at Florida public college enrollment rates – it did not examine out-of-state college or private college enrollment due to lack of available data. Dr. Chingos asserts (p. 11) that other national data suggests then that these enrollment rates could be conservative.

+++

U.S. News and World Report: “Study: School Choice Program in Florida Boosts College Enrollment” http://bit.ly/2k2THPF

Step Up for Students: “Study: FL private school choice students more likely to get to college, get degrees” http://bit.ly/2hA7VCO

+++

Florida Tax Credit Scholarship Facts:

FLORIDA – A DECADE OF PROGRESS (1999-2009)

The state of Florida adopted comprehensive education reform, including private school choice, under former Governor Jeb Bush. These reforms have been supported by subsequent Governors and state legislators to the benefit of Florida’s K-12 students. They enacted several K-12 education reforms beginning in 1999 that included:

Because Florida’s reforms have been in existence the longest, it is more heavily researched than other states, as demonstrated in the following sections.

Impact on Public School Achievement: Closing the Racial Achievement Gap

As these reforms took effect, Florida students’ National Assessment of Educational Progress (NAEP) scores– an exam the federal government has administered every two years since the early 1990s –increased relative to their national peers.

In 2003, when all 50 states first participated, Florida fourth-graders ranked 32nd in Reading. In 2009, Florida fourth-graders ranked 10th in Reading.

Between 1998 and 2009, Florida’s black and Hispanic students made a 25 point increase on the fourth-grade reading NAEP tests, making twice as much progress as the national average for black and Hispanic students.

According to Matthew Ladner, Ph.D. and Lindsey Burke, “in 1998, Florida’s black students scored below the national average on fourth-grade reading, approximately 1.5 grade levels below even the most poorly performing states. By 2009, Florida’s black children outscored or tied statewide averages for all children in eight states: Alaska, Arizona, California, Hawaii, Louisiana, Mississippi, Nevada, and New Mexico. Black children in Florida pulled off this feat despite the fact that all eight states improved somewhat themselves between 1998 and 2009.”

Florida’s Hispanic students fared even better. On the 2009 fourth grade reading NAEP, Florida’s Hispanic students outscored or tied 31 state averages. On this measure, the racial achievement gap between white students nationally and Hispanic students in Florida has dropped by 76 percent since 1998.

Choice in Florida and the Relationship to Academic Success

Additionally, there is strong evidence that Florida’s private school choice program is achieving results for the students participating in it. Extensive evaluations have been done on the Florida Tax Credit Scholarship Program, which is now serving nearly 100,000 low-income students. In 2006, the state legislature required that every scholarship student take a nationally norm-referenced test every year. Those test scores are reported to a University of Florida research team that writes an annual evaluation. The research team, led by Dr. David N. Figlio since 2008, has consistently found that:

There is also direct evidence that the Florida choice program has contributed to the rising academic achievement of the public schools in the state. In 2010, Professors Figlio and Hart of Northwestern University, examined that very question and found that:

INDIANA – REFORM RESULTS (2011-2016):

The state of Indiana adopted comprehensive education reform, including private school choice, under former Governor Mitch Daniels. These reforms were supported and strengthened under former Governor Mike Pence and subsequent state legislatures to the benefit of Indiana’s K-12 students. Indiana’s reforms were similar in many respects to Florida’s, including:

Indiana’s voucher program is one of the most expansive and highly accountable in the country, and is aimed at low-income and lower middle-class students statewide. The program has grown exponentially, from 3,900 students enrolled the first year (2011-12 school year) to nearly 35,000 students in the 2015-17 school year. With such rapid growth the challenge is now working to ensure that there are enough high quality private schools to meet the demand.

Impact on Public School Achievement

Indiana’s reforms are already having an effect on academic achievement. The state has seen a sharp increase in its NAEP scores since the 2011 education reforms were implemented.

In 2011, Indiana fourth-graders ranked 27th in Reading. In 2015, Indiana fourth-graders ranked 9th in Reading.

The percentage of fourth graders reading at a basic and above level jumped from 67 percent in 2011 to 75 percent in 2015.

COLLEGE ENROLLMENT AND COLLEGE GRADUATION:

The Effects of the Florida Tax Credit Scholarship Program on College Enrollment and Graduation: An Update

www.urban.org/sites/default/files/publication/99728/the_effects_of_the_florida_tax_credit_scholarship_program_on_college_enrollment_and_graduation_0.pdf

ACADEMIC OUTCOMES FOR PARTICIPATING STUDENTS:

Joshua Cowen (2008). School Choice as a Latent Variable: Estimating the “Complier Average Causal Effect” of Vouchers in Charlotte. Policy Studies Journal, 36(2). 301—315.

onlinelibrary.wiley.com/doi/10.1111/j.1541-0072.2008.00268.x/abstract

Jay P. Greene (2001). Vouchers in Charlotte. Education Matters, 1(2), 55—60.

educationnext.org/files/ednext20012_46b.pdf

Jay P. Greene, Paul Peterson, and Jiangtao Du (1999). Effectiveness of School Choice: The Milwaukee Experiment. Education and Urban Society, 31(2). 190–213.

www.uark.edu/ua/der/People/Greene/Effectiveness-of-school-choice.pdf

Cecilia Rouse (1998). Private School Vouchers and Student Achievement. Quarterly Journal of Economics, 113(2). 553–602.

www.nber.org/papers/w5964.pdf

William G. Howell, Patrick J. Wolf, David E. Campbell, Paul E. Peterson (2002). School vouchers and academic performance: results from three randomized field trials. Journal of Policy Analysis and Management.

onlinelibrary.wiley.com/doi/10.1002/pam.10023/abstract

Patrick J. Wolf, Brian Kisida, Babette Gutmann, Michael Puma, Nada Eissa, and Lou Rizo (2013). School Vouchers and Student Outcomes: Experimental Evidence from Washington, D.C. Journal of Policy Analysis and Management, 32(2). 246–270.

onlinelibrary.wiley.com/doi/10.1002/pam.21691/abstract

John Barnard, Constantine Frangakis, Jennifer Hill, and Donald Rubin (2003). Principal Stratification Approach to Broken Randomized Experiments: A Case Study of School Choice Vouchers in New York City. Journal of the American Statistical Association, 98, 310–326. www.tandfonline.com/doi/abs/10.1198/016214503000071

Alan Krueger and Pei Zhu (2004). Another Look at the New York City School Voucher Experiment. American Behavioral Scientist, 47(5). 658–698 http://dx.doi.org/10.3386/w9418 (see also Paul Peterson and William Howell (2004). Voucher Research Controversy. Education Next, 4(2). 73–78. educationnext.org/files/ednext20042_73.pdf

Bettinger, E., & Slonim, R. (2006). Using experimental economics to measure the effects of a natural educational experiment on altruism. Journal of Public Economics, 90(8), 1625-1648.

Marianne Bitler, Thurston Domina, Emily Penner, and Hilary Hoynes (2015). Distributional Effects of a School Voucher Program: Evidence from New York City. Journal of Research on Educational Effectiveness, 8(3). 419–450. www.nber.org/papers/w19271.pdf

Atila Abdulkadiroglu, Parag A. Pathak, and Christopher R. Walters (2015). School Vouchers and Student Achievement: First-Year Evidence from the Louisiana Scholarship Program (NBER Working Paper 21839). National Bureau of Economic Research.

Jonathan N. Mills and Patrick J. Wolf (2016). The Effects of the Louisiana Scholarship Program on Student Achievement After Two Years (Louisiana Scholarship Program Evaluation No. 1).

www.uaedreform.org/downloads/2016/02/report-1-the-effects-of-the-louisiana-scholarship-program-on-student-achievement-after-two-years.pdf

ACADEMIC OUTCOMES FOR PUBLIC SCHOOL STUDENTS:

Anna J. Egalite (2016). The Competitive Effects of the Louisiana Scholarship Program on Public School Performance (Louisiana Scholarship Program Evaluation Report No. 4).

educationresearchalliancenola.org/files/publications/Report-4-LSP-Competitive-Effects.pdf

Anna J. Egalite (2014). Competitive Impacts of Means-Tested Vouchers on Public School Performance: Evidence from Louisiana and Indiana (Program on Education Policy and Governance Report No. 1405). Harvard University.

David Figlio and Cassandra Hart (2014). Competitive Effects of Means-Tested School Vouchers. American Economic Journal: Applied Economics, 6(1). 133–56.

www.nber.org/papers/w16056.pdf

Rajashri Chakrabarti (2013). Vouchers, Public School Response and the Role of Incentives: Evidence from Florida. Economic Inquiry, 51(1). 500–526.

onlinelibrary.wiley.com/doi/10.1111/j.1465-7295.2012.00455.x/abstract;jsessionid=53F814E21F1EBA72A3B25C344E7B57DF.f04t02

David Figlio and Cassandra Hart (2011) Does Competition Improve Public Schools? New Evidence from the Florida Tax-Credit Scholarship Program. Education Next, 11(1). 74–80. Retrieved from

educationnext.org/files/ednext_20111_Figlio.pdf

Marcus Winters and Jay P. Greene (2011). Public School Response to Special Education Vouchers: The Impact of Florida’s McKay Scholarship Program on Disability Diagnosis and Student Achievement in Public Schools. Educational Evaluation and Policy Analysis, 33(2). 138–158.

journals.sagepub.com/doi/abs/10.3102/0162373711404220

Matthew Carr (2010). The Impact of Ohio’s EdChoice on Traditional Public School Performance. Cato Journal, 31(2). 257–284.

object.cato.org/sites/cato.org/files/serials/files/cato-journal/2011/5/cj31n2-5.pdf

Nicholas Mader (2010). School Choice, Competition and Academic Quality: Essays on the Milwaukee Parental Choice Program (Doctoral dissertation).

Jay P. Greene and Ryan Marsh (2009). The Effect of Milwaukee’s Parental Choice Program on Student Achievement in Milwaukee Public Schools (School Choice Demonstration Project Report 11).

John Merrifield and Nathan Gray (2009). An Evaluation of the CEO Horizon, 1998-2008, Edgewood Tuition Voucher Program. Journal of School Choice, 3(4). 414–415.

www.tandfonline.com/doi/abs/10.1080/15582150903430764

Rajashri Chakrabarti (2008). Can Increasing Private School Participation and Monetary Loss in a Voucher Program Affect Public School Performance? Evidence from Milwaukee. Journal of Public Economics, 92(5-6). 1371–1393.

www.sciencedirect.com/science/article/pii/S0047272707000977

Rajashri Chakrabarti (2008). Impact of Voucher Design on Public School Performance: Evidence from Florida and Milwaukee Voucher Programs (Staff Report No. 315).

www.newyorkfed.org/medialibrary/media/research/staff_reports/sr315.pdf

Greg Forster (2008). Lost Opportunity: An Empirical Analysis of How Vouchers Affected Florida Public Schools.

www.edchoice.org/wp-content/uploads/2015/09/Lost-Opportunity-How-Vouchers-Affected-Florida-Public-Schools.pdf

Greg Forster (2008). Promising Start: An Empirical Analysis of How EdChoice Vouchers Affect Ohio Public Schools.

www.edchoice.org/wp-content/uploads/2015/09/Promising-Start-How-EdChoice-Vouchers-Affect-Ohio-Public-Schools.pdf

John Diamond (2007). Should Texas Adopt a School Choice Program? An Evaluation of the Horizon Scholarship Program in San Antonio (RR 03-2007). Texas Public Policy Foundation.

www.bakerinstitute.org/files/369/

Cecilia Rouse, Jane Hannaway, Dan Goldhaber, and David Figlio (2007). Feeling the Florida Heat? How Low-Performing Schools Respond to Voucher and Accountability Pressure (Working Paper 13). National Center for Analysis of Longitudinal Data in Education Research. files.eric.ed.gov/fulltext/ED509667.pdf

David Figlio and Cecilia Rouse (2006). Do Accountability and Voucher Threats Improve Low-Performing Schools? Journal of Public Economics, 90(1). 239–255.

www.nber.org/papers/w11597.pdf

ACADEMIC OUTCOMES FOR PUBLIC SCHOOL STUDENTS [CONT.]:

Jay P. Greene and Marcus Winters (2006). An Evaluation of the Effects of D.C.’s Voucher Program on Public School Achievement and Racial Integration after One Year (Manhattan Institute Education Working Paper No. 10).

www.manhattan-institute.org/pdf/ewp_10.pdf

Martin West and Paul Peterson (2006). The Efficacy of Choice Threats within School Accountability Systems: Results from Legislatively Induced Experiments. Economic Journal, 116(510). C46–C62.

onlinelibrary.wiley.com/doi/10.1111/j.1468-0297.2006.01075.x/abstract

Rajashri Chakrabarti (2004). Closing the Gap. Education Next, 4(3). 66–71.

Jay P. Greene and Marcus Winters (2004). Competition Passes the Test. Education Next, 4(3). 66–71.

Jay P. Greene and Greg Forster (2002). Rising to the Challenge: The Effect of School Choice on Public Schools in Milwaukee and San Antonio (Manhattan Institute Civic Bulletin No. 27).

www.manhattan-institute.org/pdf/cb_27.pdf

Caroline M. Hoxby (2002). How School Choice Affects the Achievement of Public School Students. In Paul Hill (Ed.), Choice with Equity. pp. 141-78.

Christopher Hammons (2002). The Effects of Town Tuitioning in Vermont and Maine, Friedman Foundation for Educational Choice.

Jay P. Greene (2001). An Evaluation of the Florida A-Plus Accountability and School Choice Program. Retrieved from Manhattan Institute

www.manhattan-institute.org/pdf/cr_aplus.pdf

Caroline M. Hoxby (2001). Rising Tide. Education Next, 1(4). 69–74.

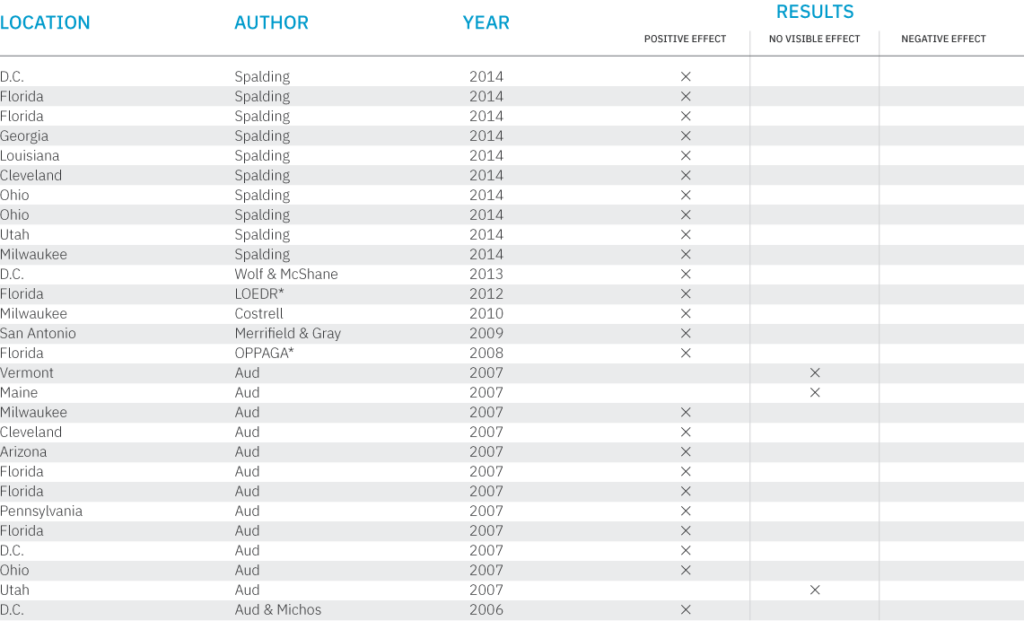

FISCAL IMPACT ON TAXPAYERS AND PUBLIC SCHOOLS:

Corey A. DeAngelis and Julie R. Trivitt (2016). Squeezing the Public School Districts: The Fiscal Effects of Eliminating the Louisiana Scholarship Program.

www.uaedreform.org/downloads/2016/08/squeezing-the-public-school-districts-the-fiscal-effects-of-eliminating-the-louisiana-scholarship-program.pdf

Martin Lueken (2016). The Tax-Credit Scholarship Audit: Do Publicly Funded Private School Choice Programs Save Money?

www.edchoice.org/wp-content/uploads/2016/10/Tax-Credit-Scholarship-Audit-by-Martin-F.-Lueken.pdf

Julie R. Trivitt, Ph.D and Corey A. DeAngelis (2016). The Fiscal Effect of Eliminating the Louisiana Scholarship Program on State Education Expenditures (The University of Arkansas Department of Education Reform Working Paper No. 2016-06).

Jeff Spalding (2014). The School Voucher Audit: Do Publicly Funded Private School Choice Programs Save Money?

www.edchoice.org/wp-content/uploads/2015/07/The-School-Voucher-Audit-Do-Publicly-Funded-Private-School-Choice-Programs-Save-Money.pdf

Patrick J. Wolf and Michael McShane (2013). Is the Juice Worth the Squeeze? A Benefit/Cost Analysis of the District of Columbia Opportunity Scholarship Program. Education Finance and Policy, 8(1). 74–99.

www.mitpressjournals.org/doi/10.1162/EDFP_a_00083#.WRB584nyvyw

Florida Legislative Office of Economic and Demographic Research. (2012). Revenue Estimating Conference. www.edr.state.fl.us/Content/conferences/revenueimpact/archives/2012/pdf/page540-546.pdf

Robert Costrell (2010). The Fiscal Impact of the Milwaukee Parental Choice Program: 2010-2011 Update and Policy Options (School Choice Demonstration Project Report No. 22).

www.uaedreform.org/downloads/2011/03/report-22-the-fiscal-impact-of-the-milwaukee-parental-choice-program-2010-2011-update-and-policy-options.pdf

John Merrifield and Nathan Gray (2009). An Evaluation of the CEO Horizon, 1998-2008, Edgewood Tuition Voucher Program. Journal of School Choice, 3(4). 414–415.

www.tandfonline.com/doi/abs/10.1080/15582150903430764

Steve Harkreader and Kimberly Barrett (2008). The Corporate Tax Credit Scholarship Program Saves State Dollars. (Florida Office of Program Policy Analysis and Government Accountability Report No. 08-68). www.oppaga.state.fl.us/reports/pdf/0868rpt.pdf

Susan Aud (2007). Education by the Numbers: The Fiscal Effect of School Choice Programs, 1990-2006.

www.edchoice.org/wp-content/uploads/2015/09/Education-by-the-Numbers-Fiscal-Effect-of-School-Choice-Programs.pdf

Susan Aud and Leon Michos (2006). Spreading Freedom and Saving Money: The Fiscal Impact of the D.C. Voucher Program. Cato Institute and Friedman Foundation for Educational Choice.

object.cato.org/sites/cato.org/files/pubs/pdf/dcvouchersrm3-cvr.pdf

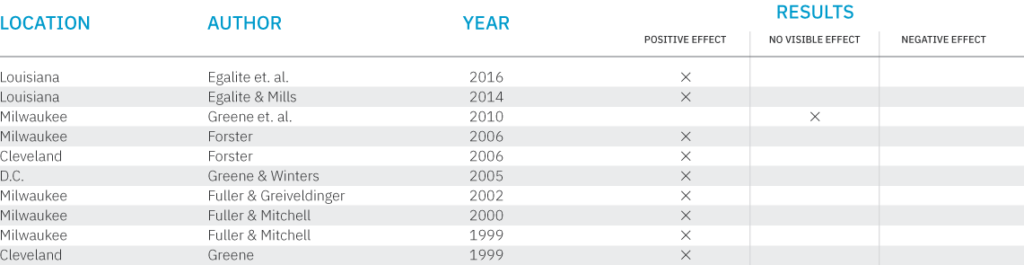

EFFECTS OF SCHOOL CHOICE PROGRAMS ON RACIAL STRATIFICATION:

Anna J. Egalite, Jonathan N. Mills and Patrick J. Wolf (2016). The Impact of Targeted School Vouchers on Racial Stratification in Louisiana Schools. Education and Urban Society, 49(3). 271–296.

papers.ssrn.com/sol3/papers.cfm?abstract_id=2738785

Anna J. Egalite, Jonathan N. Mills and Patrick J. Wolf (2016). The Impact of the Louisiana Scholarship Program on Racial Segregation in Louisiana Schools. (Louisiana Scholarship Program Evaluation Report No. 3).

educationresearchalliancenola.org/files/publications/Report-3-LSP-and-Racial-Segregation.pdf

Anna J. Egalite and Jonathan N. Mills (2014). The Louisiana Scholarship Program. Education Next, 14(1). 66–69.

educationnext.org/files/ednext_XIV_1_egalite.pdf

Jay P. Greene, Jonathan N. Mills, and Stuart Buck (2010). The Milwaukee Parental Choice Program’s Effect on School Integration (School Choice Demonstration Project Report No. 20).

files.eric.ed.gov/fulltext/ED531968.pdf

Greg Forster (2006). Segregation Levels in Cleveland Public Schools and the Cleveland Voucher Program.

www.edchoice.org/wp-content/uploads/2015/09/Segregation-Levels-in-Cleveland-Public-Schools-and-the-Cleveland-Voucher-Program.pdf

Greg Forster (2006). Segregation Levels in Milwaukee Public Schools and the Milwaukee Voucher Program.

www.edchoice.org/wp-content/uploads/2015/09/Segregation-Levels-in-Milwaukee-Public-Schools-and-the-Milwaukee-Voucher-Program.pdf

Jay P. Greene and Marcus Winters (2006). An Evaluation of the Effects of D.C.’s Voucher Program on Public School Achievement and Racial Integration after One Year (Manhattan Institute Education Working Paper No. 10).

www.manhattan-institute.org/pdf/ewp_10.pdf

Howard Fuller and Deborah Greiveldinger (2002). The Impact of School Choice on Racial Integration in Milwaukee Private Schools (American Education Reform Council Manuscript).

Howard Fuller and George Mitchell (2000). The Impact of School Choice on Integration in Milwaukee Private Schools (Current Education Issues No. 2000-02).

files.eric.ed.gov/fulltext/ED443939.pdf

Howard Fuller and George Mitchell (1999). The Impact of School Choice on Racial and Ethnic Enrollment in Milwaukee Private Schools. (Current Educations Issues No. 99).

files.eric.ed.gov/fulltext/ED441903.pdf

Jay P. Greene (Nov. 1999) The Racial, Economic and Religious Context of Parental Choice in Cleveland. Paper presented at the Association for Public Policy Analysis and Management meeting, Washington, D.C.

www.hks.harvard.edu/pepg/PDF/Papers/parclev.pdf

A slide deck of major research is here.