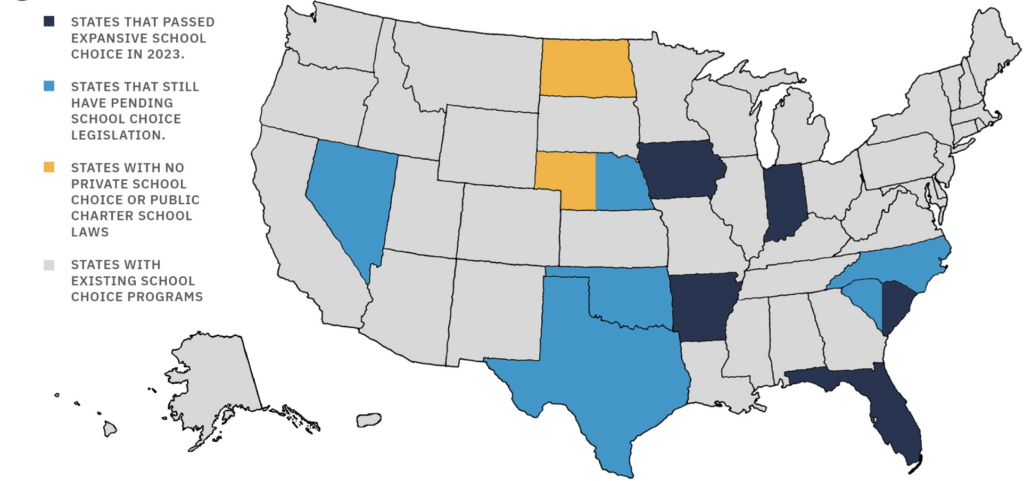

This year has been a historic year for educational opportunity in America. As support for school choice soars, lawmakers are finally listening to families and passing legislation to expand or create new programs to fund students instead of systems.

Discover school choice victories and progress in 2024.

HB 2504 – Pending

Learns Act – Passed

HB 1 – Passed

Education Savings Account Expansion – Passed

Students First Act – Passed

AB 440 – Pending

SB 406 – Pending

Refundable Tax-Credit Bill – Pending

HB 215 – Passed